Wind turbines have become a standard sight on the sides of highways and off ocean shorelines. Their growing presence may be a harbinger of a future when all the energy we produce and consume is renewable.

Driving by a static wind turbine on a windy day, one might wonder whether the giant machine is broken. Usually, this is not the case. Rather, the turbine has likely been deliberately turned off because its supply generation has exceeded current energy needs and or available storage capacity. This stalled turbine is, in fact, an underutilized turbine. Unfortunately, this is a common occurrence in the wind generation market as it is in solar production, though the evidence of underutilized solar production is less visible to the naked eye. The surprising reality is, we have more power in this country than we know what to do with it.

The advantage that traditional hydrocarbon energy has on renewable energy is not its production – as many think – but its storage capabilities. When comparing gasoline to modern battery technology, gasoline is six times more efficient than today’s lithium-ion battery (by mass). Moreover, gasoline has not yet reached its full efficiency capability, as internal combustion presently loses up to 50%-70% of its power during the fuel-burning process, depending on the make of the engine.[1] While energy loss drops with the large-scale burning of power plants, it could fall even lower with more efficient technologies in development.

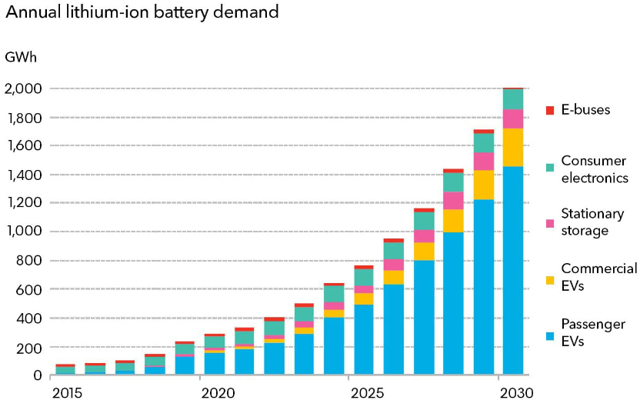

Large scale battery storage, though nascent, has experienced enormous growth. From 2003 to 2010, only 59 megawatts (MW) of large storage capacity was installed in the United States. From 2010 to 2018, 810 MW of storage capacity was added, a near 1,400% increase.[2] While that is staggering growth, the US still significantly lags the rest of the world in battery installation. Global growth over the next decade should be substantial, as many governments have announced ambitious renewable goals over this past year.

There are several ongoing projects with regards to energy storage, including the following: Lithium-based Batteries, Flow Batteries, and Alternatives.

Lithium Batteries

Lithium is currently the battery of choice, having replaced the nickel batteries of the previous generation. An analogous situation is 4G’s replacement of 3G telecom infrastructure. While 4G may seem old hat for many, vast parts of the US and other developed countries still do not have the infrastructure to properly deploy and support 4G. 5G is coming, but its use case is substantially different from 4G and will likely co-exist with its predecessor for some time. Similarly, lithium-ion (Li-ion) batteries still has a great deal of market penetration available and room to improve technologically. It is likely that Li-ion batteries will be offered more in conjunction with traditional hydrocarbons because these batteries, along with other alternatives, create a more well-rounded and stable portfolio of energy sources.

The main thrust of lithium battery development has been in solid state Li-ion batteries. Conventional batteries use a liquid medium to pass charge between the cathode and anode; however, this transmission method is notoriously unstable. Lithium anodes tend to warp and pierce the liquid medium, and this can have explosive consequences. A solid-state battery swaps out the liquid medium for a solid one made of either glass or a ceramic polymer. This solid core can resist lithium’s warping tendencies, making the battery less prone to explode and thus more likely to operate longer. Lithium based batteries remain the market leader in both small- and large-scale energy storage currently. As of 2018, 90% of battery storage was Li-ion based.[3]

United States based companies that produce Li-ion products include Tesla (TSLA), Albermarle (ALB), and Energizer Holdings (ENR). Tesla’s true potential value is not the automotive branch of the company but its battery segment, which boasts full vertical integration from mining to production. Albermarle is a commodity acquirer and a necessary supplier to most battery manufacturers. Energizer is not in the storage market, but it does make consumer grade Li-ion batteries. The company’s infamous legacy may be that it missed a significant opportunity to leverage decades of battery expertise to gain a first-mover advantage in the growing trend. Whether Energizer can catch up to competitors remains to be seen. The company did change its leadership recently, and perhaps this will lead to bigger and faster investment in Li-ion. Investors could also get Li-ion exposure by investing in foreign players like Toshiba and Mercedes; one option is to buy American Depository Receipt (ADR) shares of those companies.

Flow Batteries

The flow battery is a new technology that replaces solid cathodes and anodes with cycling liquids that transfer charge through a membrane. The composition of these liquids can vary, but the most common element is vanadium. There are also several experimental synthetic organic substitutes in development. The “flow” state of these batteries makes the technology suitable only for sedentary storage and not vehicle or other transportation applications. What it loses in application flexibility, the flow battery makes up for in scalability. The architecture of these batteries allows them to be built in larger size, facilitating greater storage capacity. This means that there is not a useful one-to-one comparison of energy efficiency between flow and Li-ion batteries.

There are (possibly) nine flow state battery sites globally: two in the US, one in Japan, two in Germany, and up to four in China. It is difficult to ascertain if the last four sites are functional, but China did announce their existence with great fanfare and the country does have the most developed vanadium mining market in the world, making the nation’s claims very plausible. Arotech Corporation used to be the only public pure play in flow batteries, but the company was purchased last year by an investment group and taken private. For those still interested in investing in the space, several holding companies like Softbank do have indirect holdings in flow battery related businesses.

Alternatives to Batteries

Batteries are by no means the only way to store energy. There are other mechanisms using both new and old technologies to store excess power production. Most of the investment in these alternative approaches has been made by private and venture capital firms, though there are some public companies like the aforementioned SoftBank with financial stakes via their portfolio holdings.

Alternative projects largely focus on pouring energy into a high-potential energy state. Once power is needed, natural forces turn that potential energy into kinetic energy, which is captured by turbines and turned into electrical power.

A conventional example is the damming of water bodies to generate hydroelectric electricity. The principal mechanism employed is gravity. Renewable energy is collected during the day as water is pumped to an elevated lake. During the night, the dam to the lake is released, water runs through the turbines, and hydroelectric power is generated.

Other alternative projects utilize similar physics principles. One example is a method of using power to stack concrete blocks in towers hundreds of feet tall during the day, then use nominal energy to pick up and drop the blocks during the night. The dropped block is attached to a turbine, which revolves as the block falls, not unlike water turning a turbine as it flows through a dam. Again, the companies involved in this technology, like the swiss Energy Vault, are privately held.

Going forward batteries remain key, whatever novel form they may take. While there have been some definite moves towards large scale production, there is much room to grow. Technological development in this sector, which has lagged production, seems to have finally allowed these companies to reach business sustainability. It is likely that over the next few years many of the privately held battery companies will look for ways for their backers to cash out. This could be done either through an initial public offering or by joining a larger energy conglomerate as traditional energy companies like BP and Exxon look to diversify from power production into power storage.

[1] Toyota Gasoline engine Reaches Thermal Efficiency of 38%, Green Car Reports, Ingram Anthony, April 14, 2014 https://www.greencarreports.com/news/1091436_toyota-gasoline-engine-achieves-thermal-efficiency-of-38-percent#:~:text=Most%20internal%20combustion%20engines%20are,around%2020%20percent%20thermal%20efficiency.

[2] Battery Storage in the US: An Update on Market Trends, US Department of Energy, July 2020

[3] Battery Storage in the US: An Update on Market Trends, US Department of Energy, July 2020