JP Marvel’s 4th Quarter 2018 letter is now available to the public. For more information on how to receive the letter when it is initially written, contact JP Marvel.

2018 was a year of highs and lows and the swings between them. The tax relief plan passed in late 2017 lifted corporate earnings expectations, leading to short-term investing exuberance. Once that enthusiasm waned, investors became bearish as they refocused on the country’s divisive politics and international trade disagreements. As the effect of the tax cut was fully digested into equity pricing in the last quarter of 2018, headwinds came back into the forefront of investors’ minds. This sobering moment led to widespread withdrawal from the market. This exit quickly accelerated beyond a rational cooling into an irrational panic that continued until the very last days of 2018. It was a selloff driven by fear and exacerbated by the abundance of automated trading. Indeed, automated trading’s continued dominance may have played a large part in the increase of market volatility (157%) in 2018 – too many “real” investors were sitting on the sidelines in cash or in passive products¹.

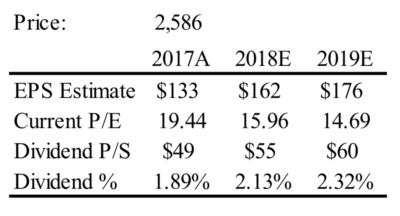

The market didn’t pull back late in 2018 in response to poor earnings reports (the reports were good) but rather from mediocre earnings outlooks. The market’s Price/Earnings (P/E) ratio contracted sharply, from 16.8 to 14.8, in just three months and now sits well below the 25-year average (16.1). The pullback could make new investments very profitable, especially if moderated corporate earnings come in as expected.

The market didn’t pull back late in 2018 in response to poor earnings reports (the reports were good) but rather from mediocre earnings outlooks. The market’s Price/Earnings (P/E) ratio contracted sharply, from 16.8 to 14.8, in just three months and now sits well below the 25-year average (16.1). The pullback could make new investments very profitable, especially if moderated corporate earnings come in as expected.

By the end of December, markets were oversold, and stocks had begun to look relatively inexpensive. The S&P 500 started to recover. Earnings were strong, but forward guidance from some companies like Apple hinted at slower growth in China and other key countries.

The US government is now in the midst of the longest shutdown in American history, and every day that passes poses greater risks to our markets, economy, and society. The federal government employs some 2.67 million civilians².

As their employer, the government has significant control over their economic well-being and purchasing power. The government’s influence also reaches far into society. As the provider of many public utilities and entitlement/social welfare programs, the government is omnipresent in its citizens’ lives. With this government shutdown, nearly every American is affected. As an example, the FDA has restricted itself to addressing only high-risk areas, and this change could compromise food safety and slow down drug approvals.

A functional government is a large contributor to consumer spending on an interstate level and to consumer confidence. If the government remains closed too long, the shutdown could do more damage to the economy than would any trade partner’s aggressive tariff position. Jamie Dimon, CEO of J.P. Morgan, stated that he believes GDP growth could shrink to 0% if the government shutdown lasts the entire first quarter. Moreover, with unemployment low, we could see some “brain drain” from government offices into the private sector before the shutdown is over.

The trade war remains a thorn in the side of many companies. The market hates stalemate and ambiguity – economies of our size are dependent on reliable, predictable rules of global commerce to operate effectively. If the rules are held in limbo for the sake of international brinksmanship, the markets of the United States and the world will balk.

Despite the government’s dysfunction, the US economy is strong and can stay strong. Wage growth continues, unemployment remains low, and US companies remain the most innovative and reliable investments in the world.

Investment Outlook

The S&P 500 finished 2018 down over 4%, its worst year since the financial crisis. The market began the year with a horrible slide, followed with a strong 10% rally, and then fell 14%. These volatile moves occurred with a backdrop of US GDP and corporate earnings expanding at their fastest paces since 2011. Tax policy changes and fiscal stimulus paced the GDP move. Strong company fundamentals led to better-than-expected revenues and margins, boosting earnings throughout the year.

Corporate earnings soared in the third quarter. S&P 500 earnings grew 28% year-over-year, the highest rate of growth we’ve seen since 2011. GDP grew 3.4%, below second-quarter growth (4.2%) but well above first quarter growth (2%). The US labor force continues to benefit from economic strength and strong corporate confidence as 312,000 jobs were added in December and the previous two months were revised higher. The unemployment rate did go up from 3.7% to 3.9% but mainly because 419,000 new workers came into the market, raising the labor force participation rate to 63.1%. Workers have also seen wage growth continue as December wages rose 3.2% from a year ago and 0.4% from the previous month.

The market ultimately fell due to concerns about the federal government shutdown, trade wars with China, a slowing global economy, continued tightening by the Fed, and the possible peaking of earnings growth. These worries may have played a role in consumer confidence recently dropping to a five-month low. People are concerned that the pace of economic growth will begin to moderate in the first half of 2019. The fall in consumer confidence is not a disaster, but it is something to watch.

We are maintaining our 2018 earnings estimate at $162 after raising it the past two quarters. This implies 20% earnings growth (including the dividend). We are also maintaining our 2019 estimate at $176 after raising its last quarter, implying 10% earnings growth.

The tax bill has encouraged both equity and fixed income investment. A lower corporate tax rate makes US stocks attractive, and a larger budget deficit will encourage the government to make its bonds more attractive. Corporate earnings were strong in 2018, and we expect the same this quarter. We also expect M&A activity to remain high in correlation with strong earnings and healthy cash balance sheets.

J.P. Marvel is presently overweight healthcare, financials, materials, and energy. We believe these sectors will continue to do well over the next several years. Former overweight sectors communications, consumer discretionary, and technology have undergone recent compositional changes, and we are currently evaluating them.

In Focus

Energy

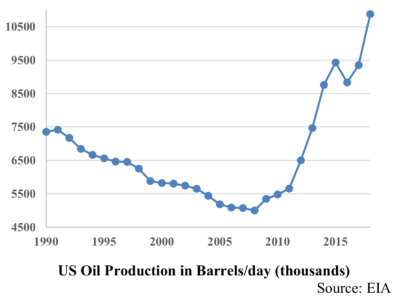

The US ended 2018 as the top producer of oil in the world, producing 10.88 million barrels per day (bpd) in December, outpacing both Saudi Arabia and Russia. It is the first year since 1991 – when the Energy Information Administration (EIA) starting recording the data – that the US has been a net exporter of oil, due in large part to the country’s production gains and excess capacity for refining oil. US oil production in 2019 shows no signs of slowing, with an additional 1.53 mm bpd of growth projected by the EIA. These developments in the US alone prove the world of energy has changed, the status quo of the 20th Century has been shattered, and a return to old norms is unlikely.

OPEC enters 2019 diminished. The Organization for Petroleum Exporting Countries (OPEC) has always been a cartel of rivals held together by Western dependence on the Middle East for its energy needs. Due to the growing power of US shale and alternative energies, the thread holding OPEC together has frayed, perhaps beyond repair. OPEC resolved in 2018 to restrict oil production, but the combined efforts of the 15 member countries and their ally Russia could not effectively restrain the amount of oil being produced. This is partially due to international production from non-members, and partially due to the inability of OPEC members to restrain themselves to such austerity. Going into 2019, OPEC has already lost one member country, Qatar, and we will see if this is a harbinger of a greater exodus.

OPEC enters 2019 diminished. The Organization for Petroleum Exporting Countries (OPEC) has always been a cartel of rivals held together by Western dependence on the Middle East for its energy needs. Due to the growing power of US shale and alternative energies, the thread holding OPEC together has frayed, perhaps beyond repair. OPEC resolved in 2018 to restrict oil production, but the combined efforts of the 15 member countries and their ally Russia could not effectively restrain the amount of oil being produced. This is partially due to international production from non-members, and partially due to the inability of OPEC members to restrain themselves to such austerity. Going into 2019, OPEC has already lost one member country, Qatar, and we will see if this is a harbinger of a greater exodus.

A weakening OPEC is an extremely dangerous situation for Saudi Arabia, the cartel’s nominal head because the country is a single resource economy that has long kept internal stability through extremely generous entitlement programs. It has pared down those programs since oil’s peak price in 2008, but the 2019 Saudi budget still requires oil prices to be $84 a barrel to avoid a deficit.

Saudi Arabia has spent the last few years attempting to diversify away from oil dependence. A recent strategy involves plans to bring its national oil company, Saudi Aramco, public. This long-awaited IPO has not gone as planned – Saudi Arabia has a lot of experience nationalizing industries and little experience bringing companies public. The Saudi Aramco IPO was pushed back from 2018 to 2019 and now to 2021. Only time will tell if it happens or if it will be pushed back further.

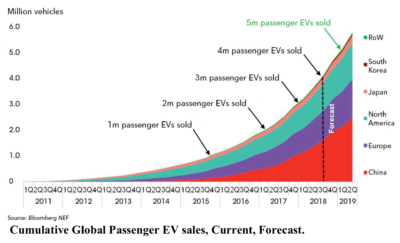

Alternative energy grew in leaps and bounds in 2018, and it looks to continue to do so in 2019. While wind power has grown in the US along the energy-hungry coasts, the true champion of renewable energy is China. Over the last few years, China has used its autocratic government power to catalyze the transformation of a ravenous consumer of “dirty” energy to a zealot of clean renewables. The pollution of the former state was so egregious that it could have been categorized as a potential threat to the governing power. The government now fully backs renewables: in 2018, when the country’s automotive market shrunk a shocking 6%, its electric vehicle niche continued to grow… with the help of government support.

However, a large portion of this green initiative is being undercut worldwide by the lack of robust infrastructure. In 2017, China lost 12% of wind energy and 6% of solar energy due to grid inefficiencies. Similar problems can be found in the US.

However, a large portion of this green initiative is being undercut worldwide by the lack of robust infrastructure. In 2017, China lost 12% of wind energy and 6% of solar energy due to grid inefficiencies. Similar problems can be found in the US.

What does this mean? It means that the balance of power has changed, and energy is transforming into a new status quo for the 21st century. The companies and countries that hope to stay ahead must invest in technology and infrastructure to facilitate this change and thrive. Is oil’s heyday over? Maybe. Is it going away? No. More importantly, energy is here to stay, and the world’s demand is growing.

Economic Summary

Third Quarter GDP growth rose at a rate of 3.4%, which is well above the economy’s growth potential (economists estimate 2%) but slightly below the 4.2% of the second quarter, which was the strongest rate of growth in four years. The economy appears to be slowing due to a widening trade deficit, sluggish business spending on equipment, and a weaker housing market. Consumer spending, which accounts for over two-thirds of US economic output, grew at 3.5%. A solid number, though personal expenditures slowed somewhat from the second quarter. The biggest driver of third-quarter growth was a buildup in inventories which contributed 2.33 percentage points. The concern here is that high inventories can curtail future production if they are not drawn down by demand. Fixed nonresidential spending rose 2.5%, which is a reflection on business investment. Spending grew but at a rate slower than the start of the year, so the tax law change effect could be slowing. Spending on homebuilding and improvements declined 3.6%, the third straight down quarter; rising interest rates are obviously affecting the housing market. Overall, the US economy remains strong but trade issues, rising rates, and diminishing tax law effects are worth watching.

The December jobs report was a shocker. Non-farm payrolls surged by 312,000 jobs, well ahead of the estimate of 176,000. Also, the unemployment rate rose from 3.7% to 3.9% but it happened because 419,000 new workers entered the workforce. The labor force participation rate increased to 63.1%, up 0.2% this month and 0.4% this year. Employment increased in healthcare (50,000 jobs added in December and 346,000 for the year), restaurants and bars (41,000 and 235,000), construction (38,000 and 280,000), manufacturing (32,000 and 284,000), and retail (24,000 and 92,000). We also saw the November and October jobs reports revised upwards. The disappointing 155,000 job number for November moved up to 176,000 and October went from 237,000 to 274,000 for a net gain of 58,000 more jobs. In addition to the big job gains, wages rose 3.2% from a year ago and 0.4% from the previous month. This tied October of for the biggest monthly rise since April 2009. All of this should alleviate fears of an impending recession as it suggests the US economy still has considerable forward momentum.

The Consumer Price Index dropped 0.1% in December, the first drop in 9 months, likely due to the large drop in gasoline prices. In the last year, CPI has increased 1.9% after increasing 2.2% in November and as much as 2.9% in July. Excluding the volatile food and energy components, the CPI increased 0.2%, the same as it has the past three months. The sharp decline in oil prices due to oversupply and slowing global economic growth is keeping overall inflation in check. In December gasoline prices dropped 7.5% after falling 4.2% in November. Food prices rose 0.4% which is its biggest gain since May 2014. Owners’ equivalent rent of primary residence advanced 0.2% in December after rising 0.3% in November. Healthcare costs also increased, going up 0.3% last month after rising 0.4% in November. The cost of hospital services rose 0.5% while the prices for prescription medication fell 0.4%. The all-items CPI rose 1.9% in 2018, a level still below the Fed’s 2% target.

The Federal Reserve increased rates 0.25% in December as expected, the Fed’s ninth rate hike since the financial crisis. The move pushes the Fed Funds rate target to 2.25-2.50%. This was done despite President Trump’s tweets against rate hikes. The language in the post-meeting statement was not entirely dovish as it did state that more rate hikes would be appropriate. Also, the Fed lowered its 2019 projection from three increases to two increases. The Fed now expects GDP rose 3.0% in 2018, down 0.1% from September’s prediction, and it projects GDP will rise 2.3% in 2019, 0.2% less than its prior projection. Three weeks after its December meeting, the Fed came out and said the policy path ahead was less clear and it can now afford to be patient about future rate hikes in 2019. The minutes revealed some members were reluctant to raise rates due to the lack of inflationary pressures. We will now watch and see if the Fed raises rates at all this year.

Equity remains our investment vehicle of choice. It is extremely important to have a long-term view and strive for efficient, after-tax returns. Corporate earnings look strong for the foreseeable future, companies continue to buy back stock and increase dividends, and we are still in a low inflation environment which typically favors equity investment.

J.P. Marvel values your feedback. We appreciate your trust, and we aspire to better serve all your financial planning and investment advisory needs.

Sincerely,

[one_fifth]Joseph F. Patton, Jr.

President & CEO[/one_fifth]

[one_fifth]Robert T. Stephenson

Director of Research[/one_fifth]

[one_fifth]Joseph F. Patton, III

V.P. of Investments[/one_fifth]

[two_fifth_last]Joel M. Roberts, CFP®, RICP®

Chief Operating Officer[/two_fifth_last]